Against the backdrop of the UK’s worst cost-of-living crisis in decades, with the annual rate of CPI inflation increasing by 10.4% in February 2023, CIPD research finds that fewer employees are finding it easy to pay their bills. Charles Cotton, CIPD’s senior policy advisor on performance and reward.

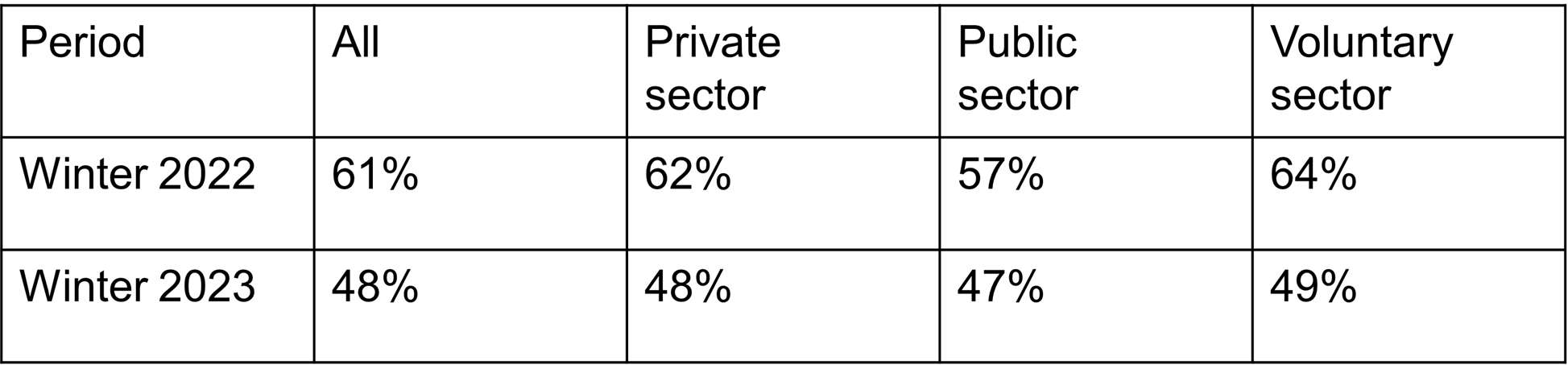

Year-to-year data from the Chartered Institute of Personnel and Development’s (CIPD) YouGov surveys shows an overall fall in people being able to keep up with their bills and commitments between winters 2022 and 2023. CIPD’s 2022 winter survey found 61% of workers were able to keep up with their bills and credit commitments without any difficulties. But in this year’s survey (which forms the basis for CIPD’s Good Work Index 2023 research), that proportion has fallen to 48%.

Percentage of employees reporting they are keeping up with their bills and credit commitments without any difficulties at the moment, by sector.

When adjusted for gender, salary and economic sector, the survey data shows some interesting contrasts in how different groups have been coping. Both men and women have seen falls in their ability to keep up with their bills and credit commitments between winters 2022 and 2023. Women fare worse in both time frames.

We see that as salaries increase, so does the ability to keep up with bills and credit commitments, with those in the lowest salary brackets struggling considerably more than those in the highest. In all cases, employees in every salary bracket have experienced falls in their ability to keep on top of bills between 2022 and 2023.

Pay is less help

In addition, between winter 2022 and 2023, our research has found that the proportion of employees reporting that their pay was enough to:

- support an acceptable standard of living, without having to go into debt to pay for food and bills, has fallen from 76% to 60%;

- cope with a sudden financial emergency costing £300 (without having to use any savings) has dropped from 63% to 49%; and

- help them save for their retirement has declined from 47% to 30%.

The data also shows that the percentage of workers saying that their employer was doing enough to support their financial wellbeing has dipped from 36% to 31% over this period.

Moreover, few of those earning less than £20,000 are now in a good financial situation, with just 39% able to say that their pay was enough to support an acceptable standard of living, only 26% able to report that their pay was enough to cope with a sudden financial emergency of £300, and a paltry 15% able to state their pay was enough to help them save for retirement.

Unsurprisingly, since winter 2022, the proportion of employees who report that money worries have affected their ability to do their job, has increased from 28% to 33%, with private sector workers impacted the most.

How HR teams can support employees during the cost-of-living crisis

Thankfully, the rate at which prices are accelerating is predicted to fall. The Office for Budget Responsibility predicts that by the end of this year, the CPI inflation will be rising by 3.8%.

However, while the increase in the cost-of-living is set to decline, most goods and services are still going to cost workers more than they did last year. It’s not just employees who now face higher prices, so do their employers, which limits the financial support they can offer their staff.

Nevertheless, the CIPD is still encouraging HR teams think how they can help their organisations review what they can do to support financial wellbeing in the workplace.

We recognise that for some employers, certain actions will take time to implement, such as creating training and development opportunities for low-waged workers. In such instances, there are still things that can be done to improve the financial wellbeing of staff relatively quickly.

These can include: tackling workplace stigma surrounding talking about money problems; signposting employees to sources of reliable and impartial financial information and guidance; offering flexible working opportunities, which can help reduce costs for those with caring responsibilities; or issuing warnings of financial scams. More ideas can be found at CIPD’s cost-of-living crisis hub, which is updated regularly.

Overall, the CIPD believes all workplaces should have a financial wellbeing policy in place with three core elements: payment of a fair and liveable wage; support for in-work progression; and financial wellbeing support. To help people professionals, CIPD have updated their guidance on employee financial wellbeing.

However, we recognise that not everything can be done in one go, so HR teams needs to review their employer’s situation and decide where investment can make the biggest.